Third party delivery services are now well embedded in our food industry, but they have had a bumpy road, especially when it comes to making a profit. We are seeing further consolidation with fewer players sharing the meager profits.

Reuters and other news services have revealed Doordash’s bid to acquire Deliveroo whose board has supported the move.

Deliveroo exited Australia in 2022, so is there any impact here?

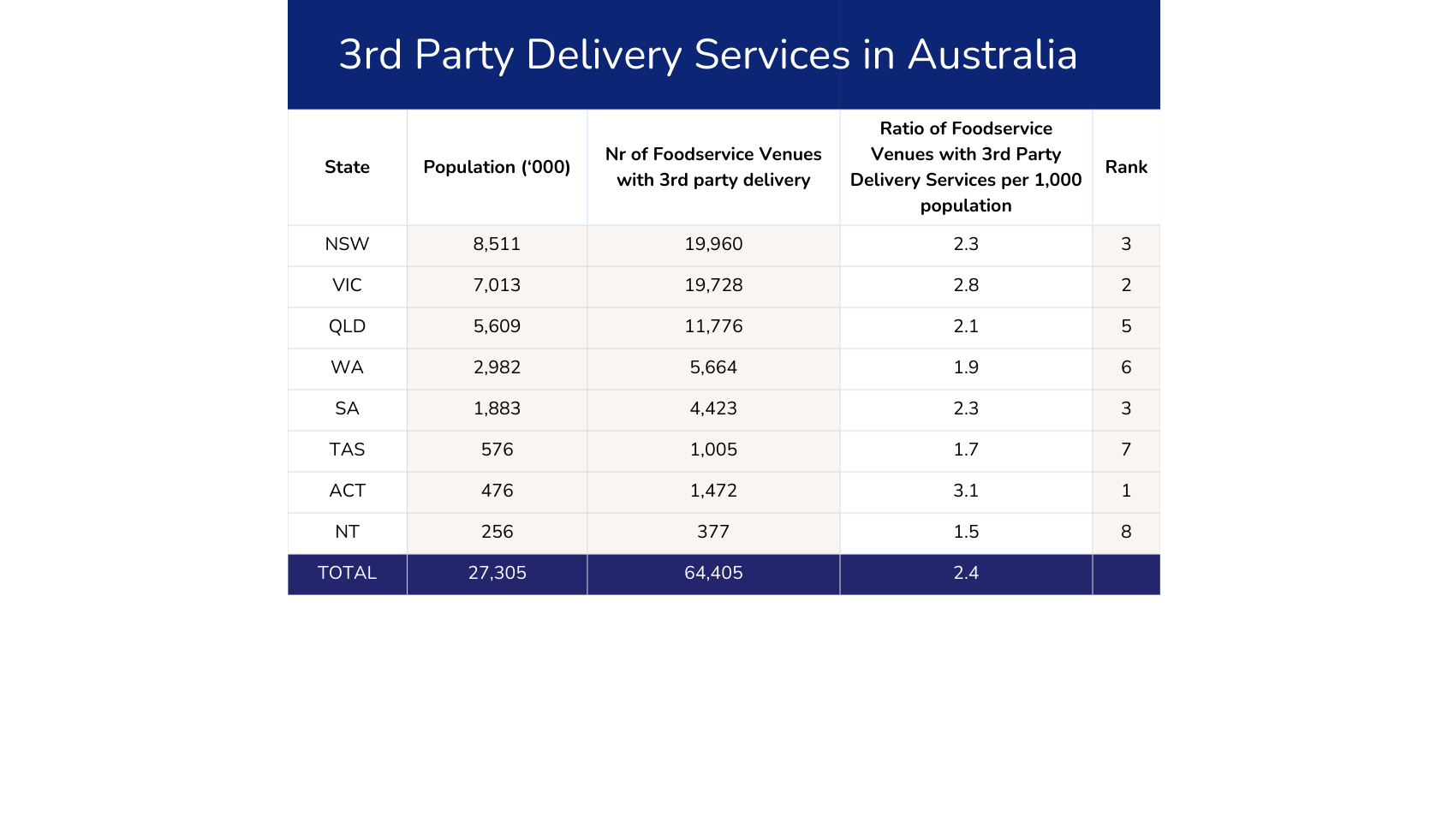

The highest penetration of delivery services in Australian foodservice is in the ACT where there are 3.1 foodservice venues with 3rd party delivery per 1,000 population. See the table for all Australian states below. There are many factors that influence the opportunity for delivery services other than population including, urban density, socio-ecomomic and generational attitudes.

Who is benefiting from the delivery concept? Venues make less money on meals, diners pay more to eat, most drivers make less than a miminum wage equivalent when costs are included and the delivery service shareholders have lost money so far!

So why do it?

Well it isn’t quite that simple. Many venues gain more orders than they otherwise would, and certainly get better marketing exposure being listed and promoted by the delivery service websites. The diners are willing to pay more for the convenience factor and many drivers see it is an extra income on top of other sources.

So the real question somes down to the delivery businesses themselves and why their shareholders accept lttle or no returns on their investment so far. The answer to that question is that many shareholders have already lost money and the ones backing the strongest players who are buying up the smaller ones, are more likely to win – but it is a long play. They haven’t received any return so far. Watch this space.

Having stable delivery services for those venues who want them is important. So, in theory, a stronger Doordash is better for Australian foodservice establishments.

Background

UK based Deliveroo was established in 2013 and has been innovative in many areas over the years growing to GBP 12.4 M revenue in 2024, and becoming profitable for the first time in that year. Market challenges such as the impact of the pandemic, the implementation of gig economy legislation and increasing costs resulted in Deliveroo exiting several markets (Australia 2022, Germany 2019, Taiwan 2018, Spain 2021, Netherlands 2022, Hong Kong 225).

Doordash started in the US around the same time as Deliveroo and has utilised similar innovations and developments and faced the same challenges. It is a much bigger player with revenue in 2024 of $USD 10.7 B (Net Proift USD$ 123M).

It is clear that size, gaining critical mass and deeper pockets, is an advantage.

Interesting Facts

The top three 3rd party delivery services offered by Australian foodservice venues are listed below (many venues offer multiple delivery options).

-

- Uber Eats – 50, 289 venues

- Doordash – 33,658 venues

- Menulog – 30,539 venues

Source: Brizo FoodMetrics filtered by foodservice venues with delivery services by State

as at 7th May, 2025.

For more data and insights on delivery services, menu, ingredients and many other attributes for foodservice venues explore Brizo Food Metrics by clicking here.